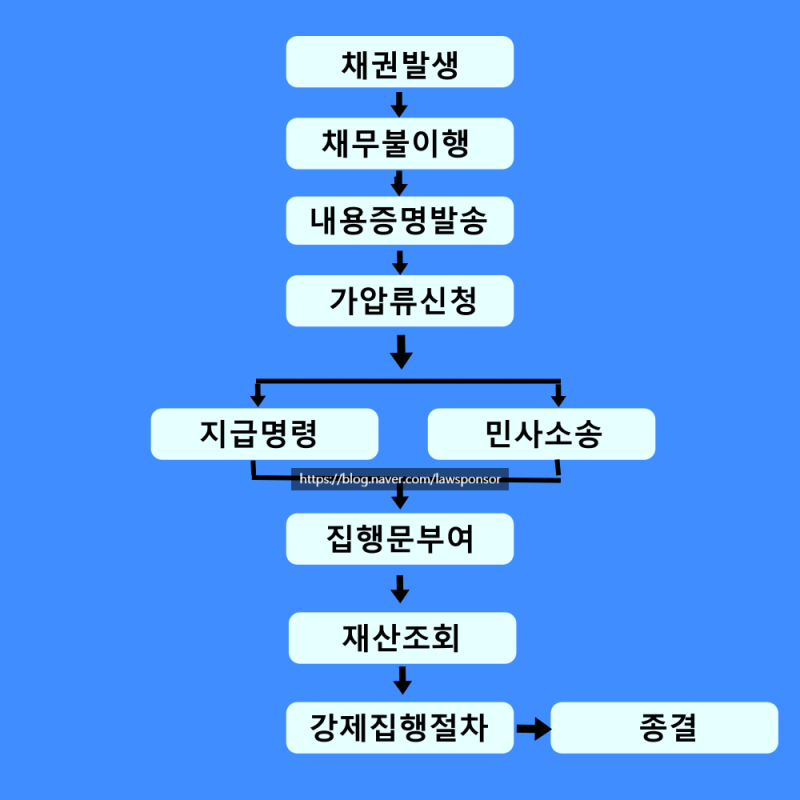

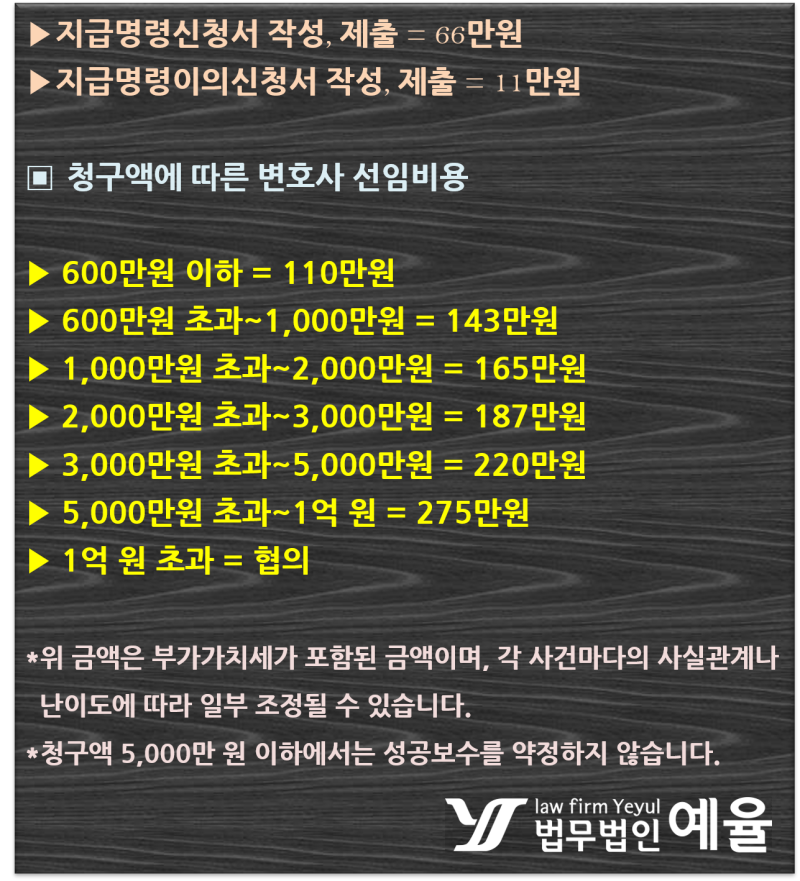

Suppose before the introduction of methods and procedures of the small claim, the definition of the term appropriate, the (claimed amount ) the value in the proceedings in the value of a civil case does not is more than 30 million won, the small trial on consolidated cases, simply and rapidly progressing by provisions. Unlike general civil judicial proceedings, the service of the debtor receives a further period of extra if there is no objection, and by the judgment as soon as possible without the expense of a merit capable of.What in the current collection company, a small collection of claims method used for I’m on my business to be the Financial Services Agency, I think that I will let you know.

Before introducing the method and procedures for collecting small claims, the term refers to the Small Claims Tribunal Act, which is simplified and expedited according to the regulations if the value of the litigation does not exceed 30 million won. Unlike ordinary civil proceedings, it has the advantage of being able to receive a judgment as soon as possible without additional time and expense if there is no objection to the service of the debtor.I would like to let you know how I collect small claims that I use in my current practice and how I will work at a collection company.

What are the business classification criteria based on the amount of the decision to recommend the collection of small claims?

As I mentioned in the other sentence, but a claim in charge of the Penal Code or the company carry out the business because the amount of claims is small when the basic, does not not ignore the debtor and the interview process. / Work) in the middle of the price at the beginning of relationship, if you think about is almost the same doesn’t have to be. However, Suppose the demand for bad debts due to the amount of standards are that you can see what’s different.the credit status of the amount of claims compared with the debtor’s actual place of residence domicile status and the company’s presence state and a job or the principal and interest as an the claim sum of the debtor’s repayment depends on the capacity but most of the small creditors in many cases, they proportional and if any, that is not property. The reason for reimbursement by the amount of claims have no choice but to considering an excessive cost of real property auction (Of course, but to liquidating distribution in the coming months, costs and compulsory execution ) part.recover the debt without progressing the assets of the debt collection method and an urgency procedure is best father.

As I mentioned in another article, when a person in charge of a debt collection company works, he or she does not ignore the basic process or meet with the debtor just because the amount of the debt is small. You can think that the initial/mid-term business is almost the same regardless of the amount of money. However, it can be seen that the standard of demand for collection of debtors according to the amount of claims is different.The credit status of the debtor relative to the amount of the claim depends on the company’s condition and the ability of the debtor to repay the amount of claims such as work, no principal, and interest. The reason for this is that we have no choice but to consider the excessive real estate auction costs (although of course we will receive dividends as compulsory execution costs in the future).There is a method of collecting debts and a demand procedure that allows debtors to proceed without property, so they can collect them well.

Methods and procedures for requesting a debtor: confirmation of whether or not the debtor’s list of non-performing persons is registered, etc.

First, it is necessary to identify which part of the debtor should be targeted for successful recovery. Ordinary creditors struggle with these parts. Most of the results of the existing application for bank or court property will be utilized, but it is questionable to what extent debtors who have already foreseen seizure and execution will be able to attend the court and submit their property in writing.Debtors Credit Inquiry/Property Investigation Property Status Principal Transaction Bank and Debit Card Opening Bank Basically collecting companies use the above breakdowns from their business partners, such as credit card opening and card loan services, cash service details, and other overdue and public record information. I think all collection work starts with an investigation and ends with paperwork and demand activities.

First, it is necessary to identify which part of the debtor should be targeted for successful recovery. Ordinary creditors struggle with these parts. Most of the results of the existing application for bank or court property will be utilized, but it is questionable to what extent debtors who have already foreseen seizure and execution will be able to attend the court and submit their property in writing.Debtors Credit Inquiry/Property Investigation Property Status Principal Transaction Bank and Debit Card Opening Bank Basically collecting companies use the above breakdowns from their business partners, such as credit card opening and card loan services, cash service details, and other overdue and public record information. I think all collection work starts with an investigation and ends with paperwork and demand activities.

As a result of the credit information company’s strengths and tireless demand,

Credit collection companies have always been compared with similar companies and offices. This is not just a matter of yesterday and today, but of respecting their opinions to some extent. However, the following parts are recognized at least by collectors working at credit information companies.Obligor Inquiry Debtor’s fluctuation status (repayment, opening, etc.) is reflected on the computer every day through steady monitoring. The person in charge calls the debtor directly and asks the debtor to pay back. I believe that the above mentioned actual debtor’s psychological pressure and the process of encouraging repayment complements the lack of documentation procedures alone. Try to do it by referring to what we’ve described.

Credit collection companies have always been compared with similar companies and offices. This is not just a matter of yesterday and today, but of respecting their opinions to some extent. However, the following parts are recognized at least by collectors working at credit information companies.Obligor Inquiry Debtor’s fluctuation status (repayment, opening, etc.) is reflected on the computer every day through steady monitoring. The person in charge calls the debtor directly and asks the debtor to pay back. I believe that the above mentioned actual debtor’s psychological pressure and the process of encouraging repayment complements the lack of documentation procedures alone. Try to do it by referring to what we’ve described.

Credit collection companies have always been compared with similar companies and offices. This is not just a matter of yesterday and today, but of respecting their opinions to some extent. However, the following parts are recognized at least by collectors working at credit information companies.Obligor Inquiry Debtor’s fluctuation status (repayment, opening, etc.) is reflected on the computer every day through steady monitoring. The person in charge calls the debtor directly and asks the debtor to pay back. I believe that the above mentioned actual debtor’s psychological pressure and the process of encouraging repayment complements the lack of documentation procedures alone. Try to do it by referring to what we’ve described.

Previous Image Next Image

Previous Image Next ImagePrevious Image Next Image